Get Pre-Approved

- See how much house you can afford at today’s rates.

Happy Buyers & Sellers 🏡 🥳

Mortgage Options for Any Situation

- Conventional, FHA, VA and USDA loans

- Jumbo loans

- Second homes

- Low down payment and down payment assistance options

- Self-employed and low-income options

- Multi-unit properties, manufactured homes

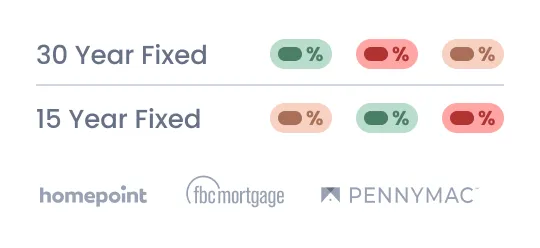

Top Lenders Compete

Mortgage Calculator

More Tools

🤔 Still have questions?

Frequently Asked Questions

Getting pre-approved for a mortgage is an important first step in the home buying process. A pre-approval gives you several key pieces of information that are critical to buying a home. Here are 3 key reasons to get pre approved:

- You get a sense of how much home you can afford. This is important for you to understand when shopping for your new home. Most Realtors strongly encourage their buyers to get pre approved before even starting the home search. Both you and your Realtor want to focus your efforts looking for homes in the correct price range. Getting pre-approved will save you a lot of time.

- You can begin to look at the mortgage options that work best for your financial situation. Many believe that a mortgage is just a mortgage. However, when working with a licensed mortgage professional, you can look at term, payment, and rate options that best suit your needs. That process starts with a pre-approval.

- You can move quickly when you find the perfect property. While a pre-approval is not an official approval, you know you are on the right track for financing when your dream home comes along. Many sellers only want offers from pre-approved buyers. When you find the right place for you, you want to be ready to put in a competitive offer.

A pre-qualification can be a helpful tool when conducting a home search but doesn’t have the same weight as a pre-approval. The key difference between a pre-qualification and a pre-approval is verification.

A pre-qualification simply takes information you input and gives an approval assuming the information you provided is true and accurate. A pre-approval requires some proof that the information is accurate. You usually need to provide some basic information like pay stubs to verify income and a credit check. Many mortgage companies only require a soft credit inquiry which does not affect your score. You can be much more confident in your home search with a pre-approval than a pre-qualification, and it only takes a few extra steps once you’ve submitted your application.

Getting pre-approved involves a “soft” credit inquiry, similar to what is used for credit card offers you get in the mail, and does not affect your credit. You are not officially applying for credit with a pre-approval, therefore your score will not be affected at this stage.

Your loan officer will tell you in advance when a “hard” inquiry is done. This part of the process does not happen until you have found a property and want to move forward with one of the loan options discussed with your loan officer.

Certain lenders can provide a conditional pre-approval instantly. With a fast, soft credit inquiry and some basic information, they’ll have you ready to start your home search in just a few minutes!

Once you’ve been conditionally approved, you’ll submit additional documents for verification. This can usually be done safely and securely online with your phone. Your licensed loan officer will be there to guide you through the process.

You’re pre approved! Now what?

Your loan officer will let you know the amount you have been pre-approved for and give you a pre-approval letter. They may even share that pre-approval letter directly with your real estate agent with your permission. The pre-approval letter will have an expiration date on it that will generally be 90 days from application date.

What if my home search takes longer than 90 days?

Not to worry, you’ll simply submit another pre-approval form. They are easy and fast to fill out. Most mortgage companies provide pre-approvals free of charge. Pre-approvals have time limits just to ensure the information is the same as when you first filled it out.

Helpful Resources

Can You Sell a House with Lead Paint

Mistakes to Avoid When Selling Your House

Benefits of Downsizing Your Home

What to Do If Your Home Sale Falls Through