🏆 How we help you

Find, buy, and save on your dream home.

(free of charge)

Get Pre-Approved

Get Grants & Programs

Find an Agent

Shop Mortgages

🤔 Why Home & Money?

Guidance at every step.

- Find top agents and lenders for your needs

- Find grants and programs to save money

- Answer questions on the home buying process

💬 Testimonials

Don’t take our word for it.

“Home & Money provided me with an agent who worked hard and diligently with me to find the perfect home for my family. My agent got in touch with me right away and after a few months got me relocated into the home I wanted.”

“Super easy to use, worked great, found an amazing agent who was able to work with us, even at long distance!! Would totally recommend using this for anyone needing an agent. Perfect for those moving out is state and needing an agent within the state you’re moving to.”

“My agent did a FANTASTIC job. He went above and beyond to make my home selling process as stress free as possible. He was always Very Informative and kept me updated . Therefore I knew what to expect”

See if you’re financially ready

Assess your financial readiness with our user-friendly tools, ensuring a solid foundation for homeownership.

Find grants and programs

Discover numerous financial aid options, tailored to your needs, to make homeownership more accessible and affordable.

Match with the perfect agent

Connect with our network of experienced, local agents who understand your preferences and guide you to your dream home.

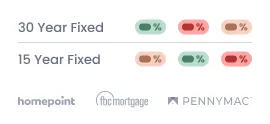

Secure the right mortgage

Get personalized mortgage options, competitive rates, and expert advice to navigate the financing process with ease and confidence.

Find your home and close

Collaborate with your matched agent to explore the best home options, and enjoy a smooth, hassle-free closing experience.

See what your home is worth

Accurately estimate your property’s value with our data-driven tools and expert insights for a successful sale.

Match with a top listing agent

Connect with highly-rated, local agents who specialize in selling homes quickly and effectively in your area.

Sell fast at the right price

Maximize your profit with strategic pricing and marketing, guided by our experienced agents, for a timely sale.

Close and move

Enjoy a seamless, stress-free closing process with our expert support, ensuring a smooth transition to your next destination.

Ready to get started?

Resources and Guides

- All

- Buying a Home

- First Time Home Buyers

- Home Renovation

- Local Markets

- Mortgage

- Selling