Closing Costs: What First-Time Home Buyers Need to Know

Key takeaways:

- Closing costs can total 3-6% of your home’s purchase price.

- In some cases, the seller may be willing to pay for all or part of your closing costs.

- Your state, city, or county may offer closing cost assistance for qualifying first-time home buyers.

What First-Time Home Buyers Need to Know About Closing Costs

When you’re buying your first home, it can be surprising to discover all the expenses beyond the actual cost of the house.

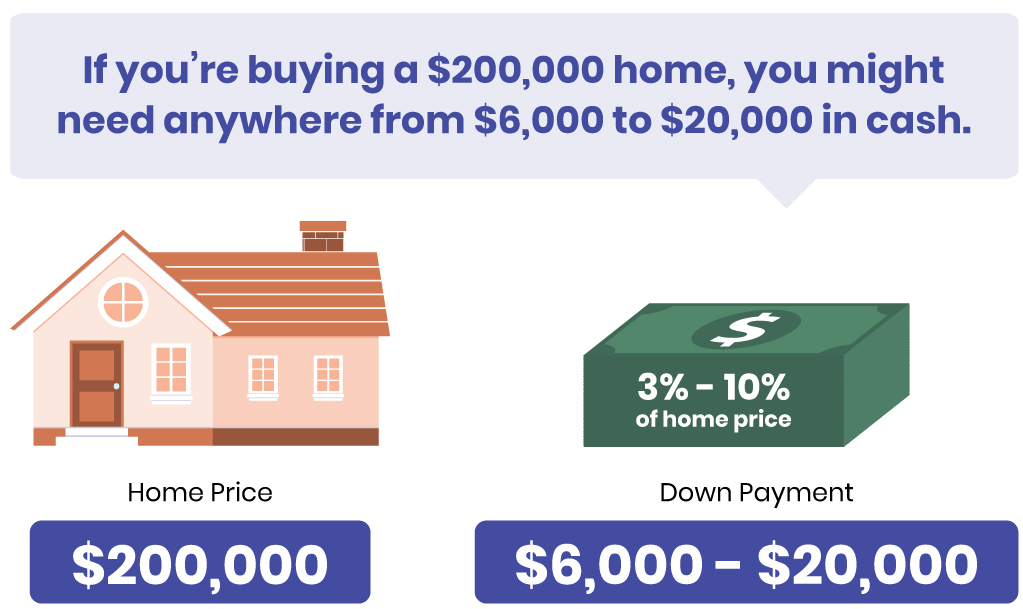

Most first-time buyers take out a mortgage loan to cover the bulk of their home’s purchase price. However, most banks require a down payment of 3-10%. If you’re buying a $200,000 home, you might need anywhere from $6,000 to $20,000 in cash on top of your mortgage loan to cover the rest of the purchase price.

And then there are the closing costs—the legal, administrative, and banking fees you’re required to pay before taking ownership of your new home.

How much do you need to save for closing costs above and beyond your down payment? In this short guide, we’ll give you a crash course in first time home buyer closing costs.

What are Closing Costs?

Whenever you close a real estate transaction, it comes with certain costs. From real estate taxes to appraisal fees, there are myriad expenses to consider when it comes time to sign on the dotted line.

So how much will you owe?

When you take out your loan, your bank will tell you how much you should expect to pay in closing costs, and they will also ask you to prove you have a way to cover them.

If you’re saving up for a home, you should be prepared for closing costs ranging from 3% to 6% of your home’s purchase price (although that number can vary significantly by state).

Here are some of the components of your closing costs:

- Banking Fees and Taxes – Your lender charges you certain fees for your transaction. This can include your state’s mortgage recording tax as well as a loan processing fee. Your lender should disclose these fees upfront. You can always try your hand at negotiation, but some costs are inflexible.

- Property taxes – Depending on your state and local laws, your property and school taxes may be due at the time of closing. Alternatively, your bank may ask you to pay them in advance and then hold them in escrow (in the bank’s account) until tax season.

- Appraiser and Inspector Fees – If your bank paid for your home inspection or your home appraisal, they’ll ask you to pay these professionals’ fees at the time of closing.

- Legal Fees – Most home buyers use a lawyer to assure they’re getting a fair contract. You may pay your lawyer directly, or they may bill the bank for your services at closing.

- Title Transfer Fees – A home is officially yours when your name is put on the title. There is usually a fee for a title transfer, and your bank will likely require you to take out title insurance to protect you (and them!) from any unknown liens on the title (i.e., a debt owed by the previous title owner).

- Homeowner’s Insurance – Your bank will require you to take out insurance. You can pay for a policy yourself before closing, or send the insurer the bank’s billing information. Then, they’ll pay your insurer out of your closing costs and mortgage payments.

While many of these fees are small, they can add up, resulting in significant closing costs.

Can the Seller Pay My Closing Costs?

In some cases, you can ask the seller to pay for all or part of your closing costs. This is called a seller concession.

Why would they pay? The seller is already poised to make a profit on the real estate transaction, and they may be willing to accept a slightly smaller check from your mortgage lender to make the transaction go smoothly.

For example, if the seller is expected to receive $100,000 and you owe $3,000 in closing costs, they could choose to accept $97,000 from the bank.

The key to getting seller concessions is a solid strategy and complete transparency.

- The right time to ask for selling concessions is well before your closing date. You don’t want to lose your home at the last minute because you try to pressure the seller into paying.

- In a competitive real estate market where there are more buyers than sellers (a “seller’s market”), sellers are unlikely to pay closing costs.

- However, if a home has been on the market for an extended period, a seller may be more willing to negotiate.

Tricky negotiations like seller concessions are one more reason why most buyers need legal representation to help them through the transaction.

First Time Home Buyer Closing Cost Assistance

If you’re shopping for a first home in a booming real estate market, it’s essential to come up with a plan for closing costs rather than assuming the seller will pay them.

If you’ve only saved enough money for your down payment, you may be concerned about coming up with the extra cash.

However, some state, county, and city programs offer grants and loans for closing cost assistance.

- Virginia offers closing cost assistance grants for up to 2% of a home’s purchase price to qualifying buyers.

- In Rensselaer County, New York, some buyers may qualify for a loan of $15,000 or $20,000 for down payment or closing cost assistance.

Check to see if there are similar resources in your area!

Getting To The Finish Line

As you begin the home buying process, you’ll likely encounter a few hurdles, from competing bids on your dream home to financial barriers.

However, there are numerous resources for first time home buyers including free education and classes, affordable loans, and closing cost assistance. Take full of advantage of your state and local resources and shop with lenders for the best mortgage rate.

With some diligence and a little luck, you’ll cross the finish line and find your dream home.