Financing Basics for First-Time Home Buyers

Key takeaways

- Programs that allow a down payment as low as 3% are available to first-time home buyers.

- Specialized programs offer down payment assistance to reduce upfront costs for first-time home buyers.

- Many first-time home buyer loans have lenient credit score requirements.

- Qualified borrowers who are required to pay private mortgage insurance (PMI) may request that it be removed once they have 20% or more in home equity.

Purchasing your first home can feel overwhelming and confusing. You must figure out how much you can afford, come up with the down payment, and find the right home. At the same time, home prices have steadily increased over the past few years.

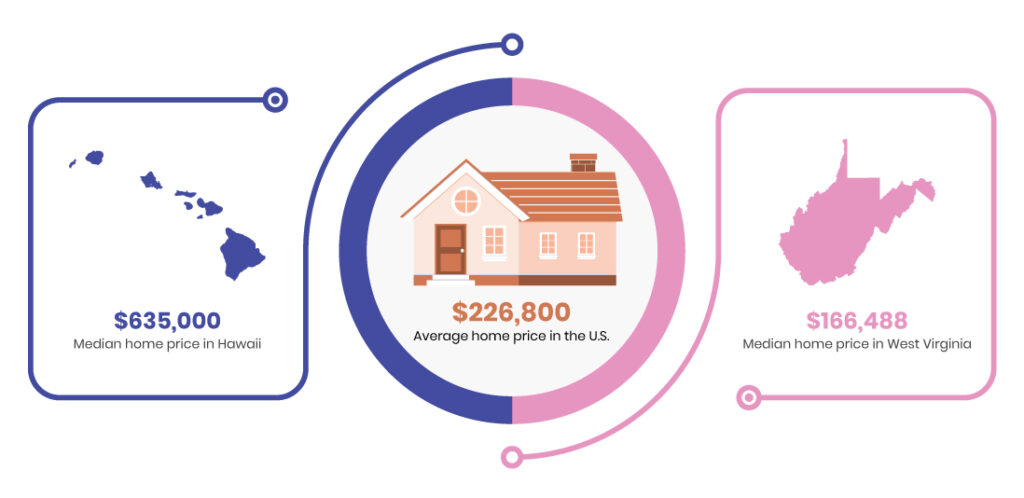

The average home price in the United States is $226,800, but averages vary wildly by state. The median home price in West Virginia, for example, is $166,488, while the median home price in Hawaii is $635,000. In any case, home buyers must come up with thousands of dollars for a down payment and navigate a complex financing process full of potential pitfalls.

A few tips can assist with determining how much to borrow, how to come up with the down payment, and how to select the right first-time home buyer mortgage for your circumstances.

First-time home buyer pre-approval

Most lenders prefer a debt-to-income ratio that doesn’t exceed 36% of your gross income. Only 28% of that amount should be the mortgage payment. For example, let’s say that you and your spouse decided to purchase a home and your combined gross income is $4,000 a month. A monthly mortgage payment of $1,120 would be considered an affordable amount.

No more than 40% of your income should go towards debt before you decide to purchase a home, so you should aim to pay down your debt as soon as possible. This will free up more cash for your monthly mortgage payment and allow you more flexibility in shopping for the right home.

Understanding down payment

The average down payment on a home is about 12%. Despite this fact, there is a misconception among buyers that you must have a 20% down payment. A 2017 survey found that two in five people believe that to purchase a home you must have at least a 20% down payment.

A variety of home loan programs allow you to get into a new home for a far less upfront cost. Lenders allow you to use a variety of sources to make up the down payment, including:

Down payment assistance programs. Many state and local governments offer down payment assistance programs to first-time home buyers. Eligibility is typically based on the borrower’s income and the purchase price of the home.

Gift funds. You can receive gift funds and use that money toward the purchase of a home. These gift funds can come from a variety of sources, such as family or friends, but the source must certify that you are not required to repay the money. For example, let’s say that your parents give you funds to use as a down payment. The participating lender may require a letter stating the givers’ relationship to you and that you are under no obligation to repay the amount.

Early IRA withdrawals. If you or your spouse has an IRA, special rules allow you to use up to $10,000 without incurring the 10% early withdrawal penalty. For example, you and your spouse may each withdraw $10,000 from your IRAs, for a total of $20,000 to use toward a home down payment. Note that although you aren’t required to pay an early withdrawal penalty on the funds, you are liable for income tax.

Understanding the loan program types

There are many first-time home buyer loan options available and each program has a different set of rules and requirements. Here are a few options that are popular with first-time home buyers due to low down payment requirements, lenient credit score qualifications, and other flexible features.

- Federal Housing Administration loan (FHA loan). This home loan is designed for low- to moderate-income borrowers and requires a lower down payment and credit score than are usually called for. You can put down as little as a 3.5% down payment. A credit score of at least 580 is required to qualify.

- Veterans Affairs loan (VA loan). This payment assistance program is designed by the government to assist service members with home purchases. VA loans are unique in that they have no down payment or credit score requirements. The program also doesn’t charge private mortgage insurance for a down payment of less than 20%, unlike conventional loans.

- U.S. Department of Agriculture loan (USDA loan). The USDA loan is a lesser-known program and requires no down payment for eligible rural and suburban home buyers. These loans are issued through the USDA Rural Development Guaranteed Housing Loan Program.

- Conventional 97 loans. The conventional 97 loan is a low-down-payment mortgage that is a low-cost loan option for first-time home buyers. Qualified borrowers only need to have a 3% down payment. “First-time home buyer” is defined as a borrower who hasn’t owned property in the past three years. There is no borrower income limit, which means that higher earners are not disqualified. A credit score of at least 680 is required for this payment assistance program.

The main takeaway here is that down payment requirements are flexible. If you don’t have a large down payment, that doesn’t exclude you from many programs. Additionally, low credit scores don’t necessarily put you out of the running.

Understanding mortgage insurance

If you select a program that requires less than a 20% down payment, mortgage insurance may be required. Private mortgage insurance (PMI) costs anywhere between 0.5% and 1% of the loan amount on an annual basis. That means that you could pay as much as $2,000 annually, or $166 a month on a $200,000 loan, assuming a 1% PMI fee.

Having a PMI payment added into your monthly mortgage amount will lower the amount of money that you can borrow on a home. Consider PMI requirements on potential loan programs.

- VA programs: No PMI is required.

- FHA home purchases: PMI amounts can range from 0.45% to 1.05% annually.

- USDA home purchases: PMI is typically 0.35% of the loan balance annually, paid monthly.

- Conventional 97 loans: The loan amount varies anywhere from $75 to $125 per $100,000 borrowed, depending on the borrower’s credit score.

Once you build up at least 20% equity in your home, you can request that the lender cancel this insurance. For example, let’s say you purchased a $200,000 home and put down $6,000 (3%). Since that time, your home’s value has increased to $350,000. You now have over 20% equity in the home (since it has appreciated far more than the $70,000 that would equal 20% of the total value). As a result, you can work with your lender to request that PMI be removed from your monthly payment, saving you money.

Securing the right financing

Purchasing a home is likely the biggest decision of your life. Finding the best first-time home buyer loans can help save money, minimize upfront expenses, and assist with getting you into your ideal home faster.

However, it’s important to understand the process, potential upfront costs, and common pitfalls involved so that you can navigate home buying with greater ease. Understanding the specialized options available to first-time home buyers and maximizing your use of those programs can help minimize the costs associated with owning your first home.