What is The Average Age of First-Time Home Buyers?

Key takeaways:

- The average age of a person who becomes a first-time homeowner has increased by 16 years since the early 1980s.

- More people are holding off on homeownership, due to rising housing costs and large amounts of student loan debt.

- Those who are ready for homeownership have access to special programs and grants that make homeownership more achievable.

The average age that people purchase their first home has steadily risen. The average age of first-time home buyers has reached age 47, a sharp increase from age 31 in 1981. The age rose eight years alone after the Great Recession.

Cities that are popular with young people are experiencing rapid population growth and rising home prices. Additionally, after the Great Recession, many homebuilders shifted focus to high-end, more expensive homes, leaving fewer entry-level homes for first-time home buyers, which further drove up the average first-time home buyer age.

An additional setback for young potential homeowners is student loan debt. A study conducted by the National Association of Realtors and the nonprofit American Student Assistance found that 83% of non-homeowners said that student loan debt delayed their ability to buy a first home. The report further found that student debt delayed homeownership by a median of seven years for millennials. A large debt, such as student loans, throws off the debt-to-income ratio that lenders use to qualify borrowers, making it difficult to purchase a home.

What is the best age to purchase a house?

The most opportune time to purchase a home is between the age of 25 and 34 according to a recent study. The research examined over 18,000 home buyers and found that those who purchased a home during this period reap the largest benefits in terms of home equity upon reaching retirement age.

However, the reality is that the number of people who can purchase during this age range has declined from 50% in the past to only 37% of people today. So, the sooner you purchase a home, the better.

The benefits of early homeownership

Younger people have been reluctant to purchase homes for a variety of reasons, including high student loan balances and delays due to major life events, such as getting married. However, financial experts note a variety of reasons to purchase a home young, including:

Smarter spending. When you purchase a home you’re investing in your future. As you reduce the mortgage balance, home equity will increase; helping you to build a nest egg for retirement.

Potential tax breaks. The mortgage interest that you pay may be tax deductible. Additionally, if your property value increases by less than $250,000 and it’s been occupied as a primary residence for more than two years, you may not need to pay capital gains tax when selling the house.

Positive credit score benefits. If you always make your payments on time, a home mortgage can help you improve your credit score. As a result, getting new loans and the lowest available interest rates will save you money.

Locked in monthly payment. A mortgage allows you the freedom of knowing exactly what you’ll pay for housing each month. You are protected from the rent increases that non-homeowners face when budgeting monthly expenses

Before you purchase your first home, it’s important to understand what to expect during the process and what types of costs are involved.

Understanding the debt-to-income ratio — why does it matter?

A high debt-to-income ratio makes it difficult, if not impossible, to buy a home. When housing prices are high, and people are weighed down with large amounts of debt (such as student loans), qualifying for a mortgage is difficult. So, what exactly is the debt-to-income ratio?

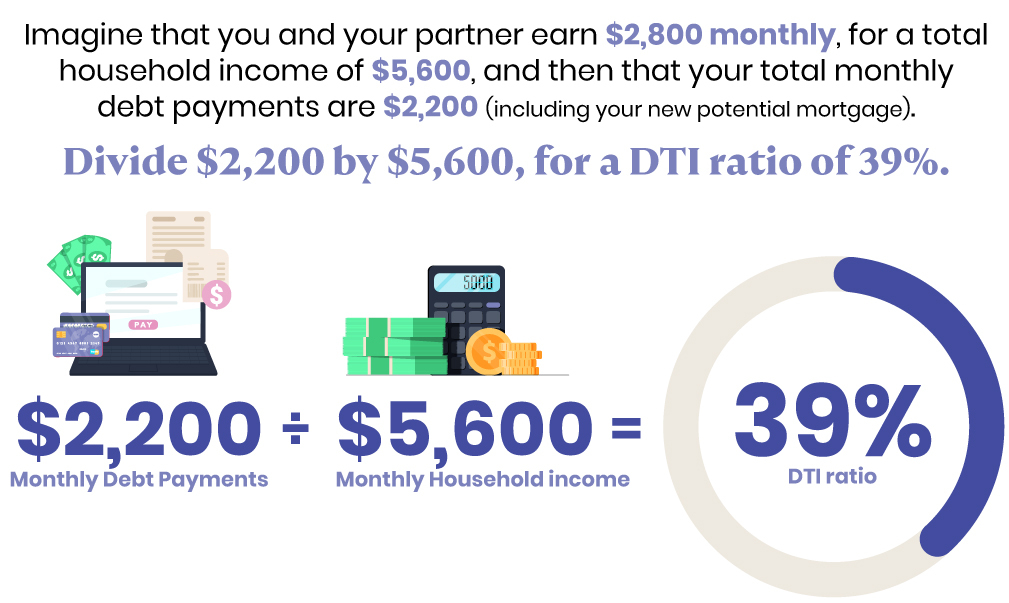

The debt-to-income ratio, also known as a DTI ratio, is a metric that mortgage companies use to determine whether you can afford a mortgage payment. The two critical numbers in this calculation are gross income and total debt. Total debt includes your car payment, credit card payments, student loan payments, and the new potential mortgage amount. Most banks allow a DTI ratio of up to 43%. Let’s take a look at an example.

Imagine that you and your partner earn $2,800 monthly, for a total household income of $5,600, and then that your total monthly debt payments are $2,200 (including your new potential mortgage). Divide $2,200 by $5,600, for a DTI ratio of 39%. In this case, you would be within the 43% DTI ratio guideline.

Let’s take a look at another example. Let’s say that you and your partner earn a combined gross income of $4,800 a month, and your total debt is $2,400. Dividing $2,400 by $4,800 will yield a DTI ratio of 50%, which exceeds most lenders’ general rule of 43%. A lender may allow a higher DIT ratio, but that will depend on a variety of factors and is up to the individual lender and program qualifications.

How can I qualify for a home loan faster?

Qualifying criteria are designed to determine whether you can afford a home mortgage. Lenders are attempting to minimize their risk against borrower default. If you want to decrease the risk associated with giving you a loan, consider the following.

Increase your credit score. A higher credit score makes you less of lending risk, and it also ensures you get the lowest interest rate (and mortgage payment) available. Check out your credit report before applying for a mortgage.

The federal law allows you to get a free copy of your credit report every 12 months from each reporting company. Review the report for inaccuracies and make sure everything is up to date. Improve your credit score by making on-time payments, reducing the amount owed, avoiding opening new accounts, and minimizing the number of times you allow companies to pull your credit report.

Pay down debt. A large number of debt signals to lenders that you may be living beyond your means. Also, the amount that you owe makes up 30% of your credit report score. Work to pay off credit cards and other debt to reduce the total amount owed. Paying down debt will also lower your DTI ratio and make it easier to get approved for a mortgage.

Build down payment savings. Down payment savings is a large hurdle for first-time home buyers. Set up an account and start saving monthly, even if the amount is small. Keep in mind there are down payment grants and assistance to offset the cost of owning a new home.

Gather income documentation. Income is a large factor in your DTI ratio and your ability to qualify for a home. Required documentation includes paystubs and tax returns. If you’re self-employed, you typically need at least two years of tax returns. Those with traditional employment should consider that overtime may or may not be permissible when calculating income, so check with your lender.

Taking the above actions will help you be less of a credit risk to lenders and ensure that you access the best programs and rates possible, including grants.

First-time home buying programs and grants

First-time home buyers have access to exclusive mortgage programs with lower interest rates and flexible guidelines. Some programs even offer down payment assistance, which helps pay a portion or even all of your down payment. Credit score, income, and other qualifying criteria will vary based on the program. Consider the following when looking at first-time home buyer programs. If you want to become a first-time home buyer in Arizona or a first-time home buyer in Hawaii, there are many different programs to help you achieve your goal.

State-specific programs. Most states have a department of housing that provides access and details to first-time homebuying programs. These programs are typically available to first-time home buyers and offer more accessible qualifying criteria, low down payment requirements, and other perks designed to make homeownership more affordable.

FHA loans. FHA loans are a popular choice for first-time home buyers because they offer a down payment as low as 3.5% and allow a credit score of as low as 580.

Conventional 97 loans. This loan typically requires a 620-660 minimum credit score and as low as 3% down. No income cap for this program makes it a potential choice for borrowers with higher income who may not qualify for low-to-moderate-income programs.

Fannie Mae HomeReady loans. This program requires only a 3% down payment. However, your income can’t exceed the 100% median income for your specific area. A minimum credit score of 660 is required.

VA home loans. This loan is available to veterans, active-duty service members, or qualifying military spouses. No down payment is required, and the credit score criteria are flexible. The maximum DTI ratio is 41%.

USDA home loans. This program offers 100% financing, with no down payment required, and a 640 minimum credit score is allowed. However, annual income can’t exceed 115% of the U.S. median income, and the property must be located in an eligible rural area.

Down payment assistance grants. Down payment assistance grants are available to first-time home buyers. These programs are often available through your State Housing Financing Agency, which are state-chartered organizations that help local residents find affordable housing. The types of grants vary and include:

Fully forgivable grants. Down payment is usually provided in the form of a second mortgage, which is fully forgiven anywhere from 5 years to 15 years. If you sell or refinance the home before that time, you must pay the grant back in full.

Non-forgivable grants. These programs are offered as a second mortgage and usually have no interest or payment requirement. However, when you sell or refinance the home, the grant must be paid back in full.

Down payment loan programs. This type of program provides a second mortgage for the down payment, and you must make a monthly payment on the loan for the term (anywhere from 10-15 years, depending on the program).

Additionally, these grants may be used to offset down payment and closing costs. Closing costs are fees and expenses that you pay when you close on your house, beyond the down payment. This expense can be 3% to 5% of the loan amount and can include title insurance, appraisals, taxes, and other costs.

Making the right decision about homeownership

Whether to rent or buy a home is a major decision, and there are pros and cons for each option. The decision affects far more than how much money you have leftover in the bank each month; it can also affect your lifestyle and savings potential well into the future. If you are a single parent, we also have resources on how single parents can buy a home.

Many who purchase a home do so because they want to put down roots. They perceive owning a home as a solid investment and want the tax deductions and financial gains of homeownership.

On the flip side, people like to rent for flexibility and less responsibility, driving up the average first-time home buyer age. Many who wait to purchase a home, however, do so for other reasons, such as getting college debt under control. Regardless of your decision, when you decide to travel the path toward homeownership, you will find plenty of resources to support you during your journey.